By converting waste materials into heat, electricity, or fuel, waste-to-energy (WtE) not only reduces the burden on landfills but also promotes a circular economy. However, the progress of WtE adoption has been far from uniform across the globe – shaped by diverse geographic, demographic, and regulatory factors. In this article, we consider the historical context and present-day influences on WtE to explain the different growth pathways that market is likely to take.

The world generates two billion tons of municipal solid waste every year – equivalent of 10 Nimitz-class aircraft carriers. Image via military.com

The world generates more than two billion tons of municipal solid waste every year – the equivalent weight of 10 massive Nimitz-class aircraft carriers stacked on top of each other. And the world’s waste problem is only intensifying. The World Bank estimates that global waste will grow to 3.4 billion tons by 2050 – more than double the population growth over the same period.

While these two challenges may not seem related, the process of converting waste into energy has potential to address both the escalating waste management crisis and the urgent need for sustainable energy sources, particularly in developing countries.

Waste-to-energy refers to the process of harnessing the energy potential of waste materials through various technologies, such as thermal treatment (including incineration and gasification), landfill gas conversion or anaerobic digestion, depending on the waste stream to be treated. By converting waste into valuable resources, WtE minimizes total waste volumes and promotes a circular economy.

It also supports ecosystem regeneration by mitigating greenhouse gas emissions and enriching soils through nutrient-rich byproducts. Unless clearly stated differently, WtE in this article refers to thermal treatment of residual household as well as commercial waste.

With growing awareness of its potential to address the mounting waste crisis and contribute to renewable energy targets, the global growth outlook for WtE is promising. The market size was valued at US$32 billion in 2021 and is projected to reach US$44 billion by 2029.

But while WtE started replacing landfill disposal in the early 1960’s, with countries such as Switzerland, Denmark, Netherlands, and Japan being among the frontrunners, its development has varied significantly across different regions, with many still relying primarily on landfills. Therefore, it is important to consider the historical factors and present-day influences that will impact how the WtE market is likely to evolve in different parts of the world.

There are three broad pathways WtE growth might take, depending on the market’s current maturity level.

For developing countries; a much-needed waste management solution

In developing countries, urbanization and population growth have accelerated waste generation and overburdened existing waste management practices – leading to littering and open dumping.

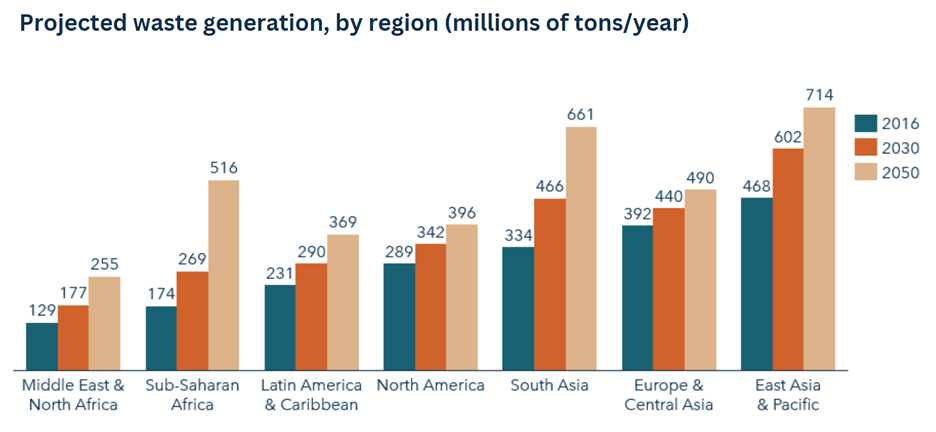

The East Asia and the Pacific regions generate most of the world’s waste by volume, with 468 million tons per year (23% in 2016). However, the fastest growing regions are Sub-Saharan Africa, South Asia, Middle East and North Africa, where, by 2050, total waste generation is expected to more than double or even triple.

Source: World Bank, What a Waste 2.0 Report

For many regions all over the world, landfilling is still the most common waste management practice, ranging from open dumping to engineered landfills. When landfills aren’t well engineered and regulated, methane and other greenhouse gases are released into the atmosphere – exacerbating climate change. WtE presents a viable alternative to landfilling, which avoids these methane emissions.

Similarly, many developing countries face challenges in finding suitable land space for waste disposal. WtE plants require less space than landfill sites – making them suitable for densely populated or land-scarce areas. By utilizing smaller footprints, these facilities free up land that can be repurposed for more productive or environmentally friendly uses.

Developing countries also often face energy shortages and rely heavily on non-renewable sources of energy, such as fossil fuels. By generating electricity or heat from waste materials, WtE plants also reduce the dependence on traditional energy sources and contribute to a more sustainable and diversified energy mix.

According to data from the International Solid Waste Association (ISWA), the number of WtE plants in developing regions has doubled in the last decade. This growth is primarily attributed to increasing awareness of environmental issues and the recognition of waste as a valuable resource. Governments and investors have started to view WtE as a viable solution to tackle waste-related problems and simultaneously promote renewable energy generation.

In the early 2000s when China was still considered to be a developing country, it made a conscious effort to move away from landfilling to adopt WtE, leading to a huge boom in new WtE capacities. Soon, it accounted for around three-quarters of the global market for WtE. More recently, Thailand and Vietnam took their first WtE plants into operation. After many years of discussion, these countries will continue their path to rely on WtE.

Successful implementation of WtE, however, requires a supportive regulatory framework, technological expertise, and investments in infrastructure – which can be harder to come by in developing regions. Despite positive trends, financial, regulatory, and political hurdles continue to slow the pace of WtE adoption in the developing world.

In high WtE adoption countries; opportunities for sorting and recycling

The waste hierarchy of ‘reduce, reuse, recycle, recover and disposal’ is the driving force of waste management plans in markets in which WtE adoption has historically been strong. In these markets, the separate collection of waste streams, such as separating organic waste to generate biogas or for the chemical recycling of plastic waste, are areas for continued growth and strategic opportunity.

Waste incineration plant in Oberhausen, Germany

For example, Germany has a well-established and comprehensive approach to WtE that prioritizes waste prevention and reuse over disposal. The country aims to recycle at least 65% of municipal waste by 2030, and has invested in advanced recycling technologies to increase the efficiency of material recovery from waste streams.

It also operates a significant number of waste incineration plants, with the energy generated being used for local district heating systems or fed into the power grid. Ash generated in the incineration process is processed to recover valuable materials such as metals and minerals suitable for construction purposes.

Another example is the city of Stockholm, which has virtually eliminated the use of landfills for waste disposal (less than 1%). The city has implemented policies to promote extended producer responsibility, pushing manufacturers to design products with recyclability in mind.

In recent years, Sweden has also introduced measures to reduce single-use plastics. For non-recyclable waste, it relies solely on WtE facilities, with energy generated being used to heat residential and commercial buildings. This has contributed to the city’s efforts to achieve a carbon-neutral status.

With little land available for landfills and high population density, Japan has also benefitted from waste-to-energy for decades. The country is now prioritizing waste reduction and recycling to achieve a more sustainable waste management system.

It has set a national target to recycle 60% of its municipal waste and has also been actively promoting resource recycling, such as turning food waste into compost and using recycled materials in construction projects. Japan has also implemented comprehensive waste separation and recycling programs to reduce the overall waste volumes, as well as public awareness campaigns to promote responsible waste sorting and recycling.

As these and other countries prioritize waste reduction, recycling, and advanced waste management technologies, businesses that align their strategies with these goals can create value, drive innovation, and contribute to a more sustainable and circular economy.

In this environment, there are many strategic opportunities to explore, including the development of smart waste collection and sorting technologies, efficient collection networks and logistics solutions, solutions that optimize supply chains for waste collection, sorting, and processing as well as chemical recycling, which has the potential to convert plastic waste back into raw materials or feedstocks for new products. There are also new market opportunities for products that are designed for circularity.

In low WtE adoption markets; biogas and product creation from incineration

The United States is, in principle, a developed market when it comes to WtE, but adoption has been and remains slow. The U.S. possesses vast landfill spaces, which, combined with a less incentivized regulatory environment, has hindered large-scale WtE adoption. Growing demand for renewable energy has sparked interest in WtE but given the country’s potential to generate energy from wind, solar, hydroelectric, and geothermal power and its historically low energy prices, there is less of an economic case for WtE compared to regions with higher energy costs.

There is, however, still plenty of opportunity for waste treatment technology to grow within the U.S. One being the production of renewable natural gas (RNG), also known as biogas, from separately collected organic waste streams. New regulatory and financial incentives are now pushing biofuel and RNG below diesel prices, while the global environment creates continued momentum. In fact, while the size of the U.S. RNG market was $3 billion in 2022, it is predicted to grow to $27 billion by 2027.

America currently has around 2,500 biogas systems, but new tax credits under the Inflation Reduction Act could accelerate the rate of growth. Furthermore, only a portion of those systems are using the biogas they produce – creating an opportunity for RNG upgrades. There is also an opportunity within the agricultural sector. Agri-waste and animal manure are predicted to be the largest RNG feedstock by 2050.

Many of the country’s 34,000 dairy farmers, particularly in states such as California, Texas, and Idaho, where the concentration of dairy farms is highest, could leverage existing sites to generate biogas as an additional source of revenue.

Agri-waste and animal manure are predicted to be the largest RNG feedstock by 2050.

Using livestock waste alone as a feedstock, there are potentially some 8,500 new biogas sites that could be developed, as well as an additional 990 animal processing sites which could supply animal waste feedstock. The American Biogas Council estimates that tens of billions of dollars of capital could be deployed resulting in hundreds of thousands of short-term jobs and tens of thousands of permanent jobs.

Captured RNG can be injected into natural gas distribution pipelines, enhancing the supply of renewable energy to homes, businesses, and industries, and can also be used as a sustainable fuel for natural gas vehicles (NGVs).

Similarly, WtE processes, such as advanced gasification, can produce hydrogen-rich syngas from waste feedstocks. This syngas can be further processed to generate hydrogen, a versatile and clean fuel with applications in transportation, industry, and power generation.

Another direction is to aim at a ‘higher value’ use of residual waste, namely, to generate transportation fuels. A number of processes are in a promising development stage.

As we navigate the intricacies of the waste and energy sectors, the future of waste-to-energy unfolds across many different pathways. By empowering developing countries with sustainable waste management solutions, transitioning to recycling-centric practices, and pioneering valuable product creation from incineration, decision-makers hold the key to shaping the sector’s sustainable evolution in their respective markets.